The Pinnacle of Pesticide Milling: Our Industrial Sand Mills

In the ever-evolving agricultural sector, the demand for effective and efficient pesticide production is paramount. As the world grapples with the challenges of sustainable farming and crop protection, the role of advanced machinery in manufacturing high-quality pesticides cannot be understated. This is where our state-of-the-art sand mills and reaction kettles come into play, offering unparalleled solutions to the pesticide industry.

Our industrial sand mills are at the forefront of pesticide milling equipment. Designed for high-efficiency and precision, these sand mills are ideal for producing a wide range of liquid pesticides, including insecticides, herbicides, and fungicides. By utilizing the latest grinding technology, our sand mills ensure uniform particle size reduction, which is crucial for the effectiveness of liquid pesticides. The result is a consistent product that meets the rigorous standards of agricultural chemical production.

Innovative Chemical Processing: Our Reaction Kettles

When it comes to synthesizing pesticides, our chemical reaction kettles offer a robust solution. These industrial mixing vessels are tailored for the complex processes involved in pesticide synthesis. Whether it’s herbicide production or fungicide formulation, our reaction kettles provide precise temperature and mixing controls, ensuring optimal reaction conditions. The durability and reliability of our kettles make them a preferred choice for pesticide manufacturers and research institutions alike.

Addressing the Needs of Modern Agriculture

Our commitment to advancing agricultural pesticide equipment extends beyond manufacturing. We understand the critical role our machinery plays in crop protection and sustainable farming. This drives us to continuously innovate and provide solutions that cater to the specific needs of the agricultural sector. From large farms to pesticide manufacturers, our sand mills and reaction kettles are designed to enhance production efficiency and product quality.

Sustainable and Eco-Friendly Solutions

In line with global efforts towards environmental sustainability, our equipment is engineered to be eco-friendly. By optimizing energy consumption and reducing waste, we are contributing to more sustainable farming practices. Our machinery is not just about meeting today’s needs; it’s about paving the way for a more sustainable future in agriculture.

Your Reliable Partner in Agricultural Machinery

Choosing the right equipment is crucial for any pesticide production process. Our range of sand mills and reaction kettles represents the pinnacle of innovation and efficiency in agricultural machinery. With our products, pesticide manufacturers and farmers can expect not only top-tier performance but also reliability and sustainability.

Expanding Our Understanding: The Comprehensive World of Pesticides

In addition to offering the finest in pesticide production equipment, it’s crucial to understand the broader context in which these products operate. Pesticides play a pivotal role in modern agriculture, but their use and impact extend far beyond simple crop protection. Let’s delve into the comprehensive world of pesticides and uncover how they are integral to sustainable agriculture.

The Spectrum of Pesticides: More Than Just Chemicals

Pesticides are often perceived merely as chemicals used for killing pests. However, this view overlooks the diverse types of pesticides designed for specific purposes. Insecticides combat insects, herbicides manage unwanted vegetation, and fungicides protect plants from fungal infections. Each category has its unique formulation and application method, ensuring targeted and effective pest control with minimal collateral impact on the environment.

Advancements in Pesticide Formulations

The evolution of pesticide formulations is a testament to scientific advancement and environmental consciousness. Modern pesticides are developed with a focus on reducing environmental impact while maximizing efficacy. This includes the creation of biopesticides derived from natural materials, offering a more eco-friendly option. The precise formulation of these pesticides, a process in which our equipment plays a critical role, ensures that they target specific pests, thereby reducing the risk to non-target species and the surrounding ecosystem.

Join Us in Shaping the Future of Agriculture

As we continue to explore the vast and intricate world of pesticides, we invite you to join us in this journey of discovery and innovation. With our advanced sand mills and reaction kettles, coupled with a deep understanding of pesticides, we are poised to revolutionize agricultural practices. Together, let’s embrace the future of sustainable agriculture, equipped with the right knowledge and the best tools.

Overview of the pesticide industry

1. Industry definition

Pesticides are mainly used to prevent and control pests, weeds and pathogens that harm crops. The actual pesticide products used are pesticide preparations made from pesticide raw materials and

pesticide auxiliaries. The pesticide raw materials play the main role and are called active ingredients or active ingredients. . In addition to being used to prevent, eliminate and control diseases, pests, weeds and other hazards in agriculture, forestry and animal husbandry, pesticides are also used in the health field for sterilization and insecticide.

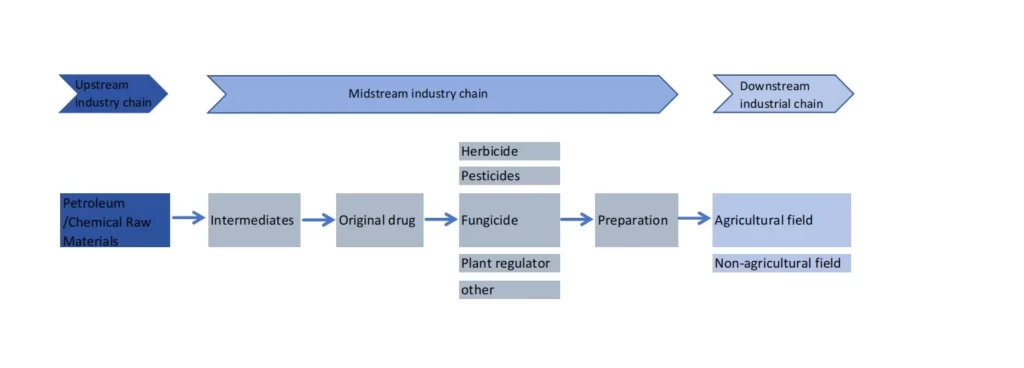

2. Industrial chain

The pesticide industry chain can be divided into three links: upstream intermediates, midstream technical drugs and downstream preparations. The upstream includes chemical raw materials and intermediates; the midstream includes technical drugs such as fungicides, herbicides, insecticides and plant growth regulators; and the downstream Serving pesticide formulation and technology.

2. Analysis of the development status of the global pesticide industry

1. Market size

From the perspective of the market size of the global pesticide industry, the global market size of pesticide products in 2020 was 60.7 billion yuan, an increase of 1.7 billion yuan compared with 59 billion yuan in the same period last year, a year-on-year increase of 2.9%. By 2021, the global market The scale reached about 62 billion yuan, an increase of 1.3 billion yuan compared with the previous year, a year-on-year increase of 2.2%. As major companies continue to develop and produce new pesticide products, it will drive the continued expansion of the existing market size. Beijing Yanjing Bizhi estimates that the global pesticide industry market size will increase to 68.5 billion yuan in 2025.

2. Market structure

In terms of the pesticide market structure, the current pesticide market segments mainly include herbicides, insecticides and fungicides. According to the latest industry analysis data, herbicides will account for the highest market sales in 2021, accounting for about 41%. Followed by the market sales of insecticides and fungicides accounted for 30% and 25% respectively, and the sales of other market segments accounted for 4% in total.

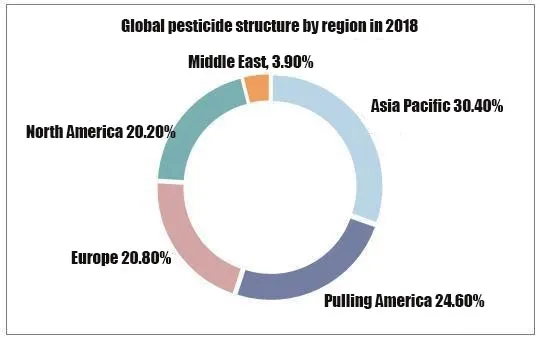

3. Global regional distribution

Since agriculture is the main industry of most countries in the Asia-Pacific region, the Asia-Pacific region is currently the world’s largest pesticide sales growth market. According to statistics from Beijing Yanjingbizhi, its pesticide market size will account for approximately 32% in 2021, a year-on-year increase of 10.5% percentage points; followed by Latin America, Europe and North

America, which account for about 26%, 20% and 18% of the market respectively; the Middle East and Africa account for 3%, and other regions account for 1% in total.

From the perspective of country breakdown, Brazil is the world’s largest pesticide user country. Its market sales in 2021 will be 31 billion yuan, accounting for about 50% of the total global market, followed by the pesticide market sales of the United States and China respectively. were 15.6 billion yuan and 11.5 billion yuan, accounting for 25.2% and 18.5% of the scale.

4. Market structure: share of major companies

The global pesticide market is mainly concentrated in a few multinational companies. The top six companies will account for 68% of the global market share in 2021. Judging from the market share of specific production companies, including Syngenta, Bayer and BASF respectively. 18%, 15%, 12%, Corteva, United Phosphate and FMC accounted for 10%, 7% and 6%, and the total market share of other companies accounted for 42%.

Noted: International large-scale pesticide companies: These companies have strong R&D capabilities, brand influence, channel networks and financial strength, and occupy a dominant position in the global pesticide market. They mainly include Bayer, BASF, Syngenta, Korda, and Dow. Dupont et al.

As global agricultural development continues to accelerate, the number of companies engaged in pesticide production continues to increase, which promotes the increase in market capacity and output, directly driving the growth of the pesticide industry.

5. Herbicides, insecticides, and fungicides occupy the majority of the market share

The global crop protection market is dominated by herbicides, fungicides, and insecticides. The global herbicide, fungicide, and insecticide market sizes in 2018 were 24.608 billion respectively. 16.319 billion and 14.549 billion US dollars, accounting for 42.75%, 28.35% and 25.28% of the global crop protection market respectively.

Development status of global pesticide market

In 2018, the global pesticide market (crop) market size was US$57.561 billion, and the non-crop pesticide market size was US$7.311 billion. The demand for pesticides used on crops is expected to be US$66.703 billion in 2023, with a CAGR of 3% from 2018 to 2023.

In terms of products, herbicides were US$24.61 billion (an increase of 5.9%, accounting for 42.7%), fungicides were US$16.32 billion (an increase of 4.7%, accounting for 28.4%), and pesticides were US$14.55 billion (an increase of 7.6%, accounting for 28.4%). 25.3%, but the growth rate in the past five years was only 0.2%. In 2018, the prices of major products increased, channel inventory was low, and cotton insect pests, etc.).

In terms of regions, Asia-Pacific (up 7.2%, accounting for 30.4%), Latin America (up 11.1%, accounting for 24.7%), and Europe (down 3%, accounting for 20.8%) occupy the main markets.

1. Global pesticide demand is mainly affected by the following factors:

Agricultural production demand: Agricultural production is the direct driving force for the demand for pesticides. With the growth of population, increase in income, changes in dietary structure and other factors, the demand for agricultural production continues to increase, and the demand for pesticides also increases.

Agricultural technological progress: Agricultural technological progress includes seed technology, irrigation technology, mechanization technology, precision agriculture technology, etc. These technologies can improve the efficiency and quality of agricultural production and reduce the use and cost of pesticides, but they will also bring about new pests and diseases. Weed problems have both positive and negative impacts on pesticide demand.

Agricultural policies and regulations: Agricultural policies and regulations are important factors affecting the demand for pesticides. Different countries and regions have different regulations on the registration, use, supervision, and subsidies of pesticides. These regulations will affect the supply and demand of pesticides, promote or Inhibit the development of pesticides.

Environmental protection and social responsibility: Environmental protection and social responsibility are important factors affecting the demand for pesticides. As people pay more attention to environmental and health issues, they have higher requirements for the safety, effectiveness, and residue of pesticides. , there is greater demand for new pesticides such as environmentally friendly, low-toxicity, and high-efficiency pesticides.

2.Pesticide industry chain

Suppliers: The suppliers in the global pesticide industry mainly include the following categories:

Chemical raw material suppliers: These suppliers provide chemical raw materials such as benzene, olefins, alcohols, and esters. They are the main raw materials for pesticide APIs and intermediates and have an important impact on the cost and quality of the pesticide industry. They mainly include Sinopec, PetroChina, and BASF. wait.

Pesticide auxiliary suppliers: These suppliers provide emulsifiers, solubilizers, synergists and other pesticide auxiliaries, which are the main additives for pesticide preparations and have an important impact on the performance and effects of the pesticide industry. They mainly include Croda, Akzono Bell, DowDuPont, etc.

Pesticide packaging suppliers: These suppliers provide pesticide packaging materials such as plastic bottles, iron barrels, and cartons. They are the main protection and transportation tools for pesticide products and have an important impact on the safety and environmental protection of the pesticide industry. They mainly include American International Paper Company, China CITIC Packaging Group, etc.

Buyers: Buyers in the global pesticide industry mainly include the following categories:

Farmers: These buyers are the end users of pesticide products. They choose different pesticide varieties and dosages based on their own needs and economic capabilities, which have a direct impact on the sales and profits of the pesticide industry. They mainly include those in China, India, Brazil and other countries. Hundreds of millions of farmers.

Distributors: These buyers are the main distributors of pesticide products. They choose different pesticide brands and quantities based on market demand and prices, which have an indirect impact on the channels and brands of the pesticide industry. They mainly include tens of thousands of agricultural products companies around the world. dealer.

Government agencies: These buyers are important regulators and purchasers of pesticide products. They formulate different pesticide standards and specifications based on national policies and regulations, which have a significant impact on the development and competition of the pesticide industry. They mainly include the US Environmental Protection Agency, the European Union Committee, Ministry of Agriculture of China, etc.